U.S. Treasury Secretary Scott Bessent has announced that the U.S. is 'ready to do what is needed' to assist Argentina in addressing its escalating financial crisis.

In a social media statement, Bessent outlined that 'all options for stabilization are on the table,' underlining Argentina's significance as a 'systematically important U.S. ally in Latin America.'

The declaration provided some relief to financial markets jittery from recent setbacks that raised doubts about President Javier Milei's ability to implement his cost-cutting, free-market agenda amidst recent local election losses.

The Argentine peso has experienced significant declines, prompting a sell-off of stocks and bonds by investors.

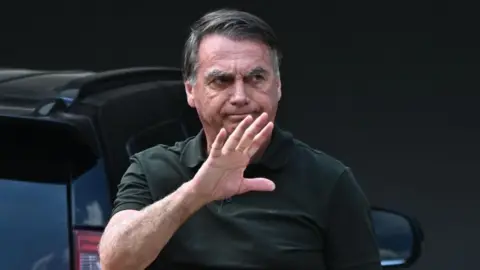

Milei, who was elected in 2023 on a platform aimed at controlling inflation through radical spending cuts, now faces critical challenges, particularly as a stable peso is crucial for his policies. In the wake of investor concerns over the stability of the currency, Argentina's central bank has intervened, depleting its reserves to support the peso.

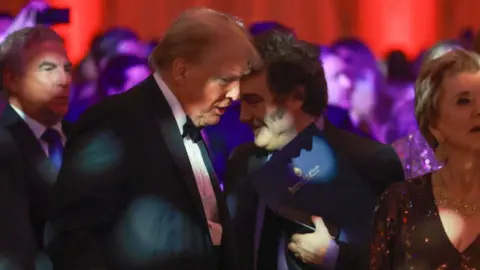

Bessent indicated that the U.S. government is exploring potential interventions, including the purchase of pesos and dollar-denominated government securities. Specific measures are expected to be discussed following a meeting between President Trump and Milei in New York.

Milei expressed his deep appreciation for the U.S. support, acknowledging its positive impact on market conditions and reinforcing his commitment to shared values of freedom and economic responsibility.

As Milei navigates political turbulence at home, including a bribery scandal involving family members and calls for impeachment, the upcoming national mid-term elections this October may serve as a crucial referendum on his government’s controversial policies, which include cuts to vital social programs.

This support from the U.S. follows previous backing from Bessent that assisted Argentina in securing a significant $20 billion loan from the International Monetary Fund.