As 2024 legislative sessions kick off, U.S. states grapple with the question of whether to adopt new federal tax breaks introduced by the Trump administration. These tax breaks include deductions for tips and overtime, which could significantly benefit workers and businesses, but also present potential risks to state budgets.

The Trump administration's policy urges states to quickly conform to the federal tax cuts, yet only a few states have acted decisively. The majority of states are approaching the issue with skepticism, weighing potential budgetary implications against the benefits of reduced tax burdens for their citizens.

The federal tax legislation enacted aims at providing $4.5 trillion in federal tax cuts over the next decade, which includes various deductions targeting individual taxpayers and corporations. However, adopting these changes is not straightforward due to different state tax laws, with many states requiring specific decisions to either adopt or reject such measures.

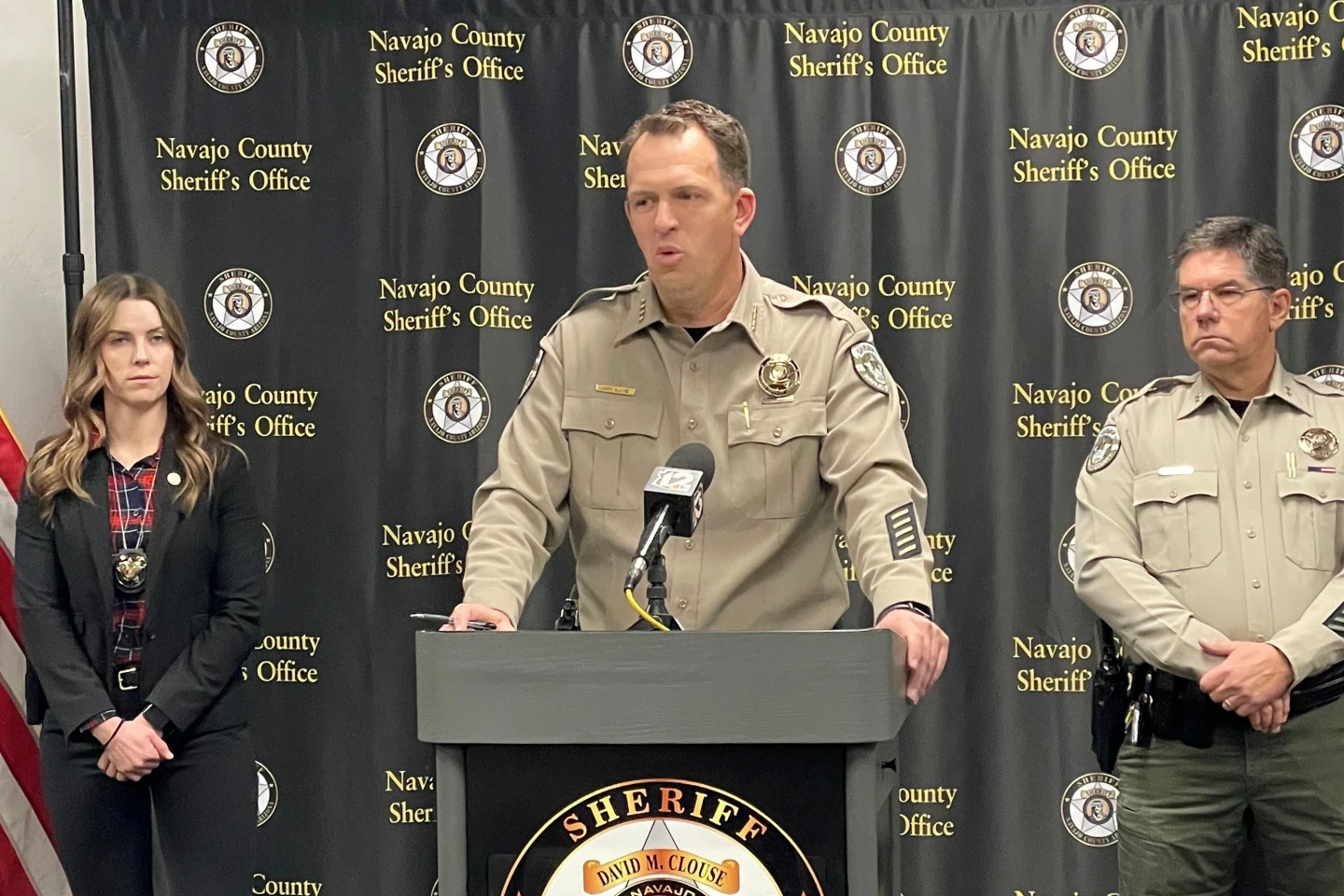

Michigan has set a precedent as the first state to opt into the tax breaks related to tips and overtime, starting in 2026, projecting significant savings for its residents. Meanwhile, other states like Arizona are considering similar actions, while some states have opted out entirely, complicating the nationwide landscape of tax policies.

Lawmakers are under pressure to respond quickly, with significant implications for average working citizens depending on their decisions. As they prepare for the upcoming sessions, the focus remains on ensuring that state budgets remain sustainable while also providing relief in taxpayer burdens.