Paramount Skydance has made another offer to buy Warner Bros Discovery as it seeks to trump a rival plan from Netflix to buy the company's studio and streaming networks.

Paramount, which is backed by the billionaire Ellison family, said it was making a direct offer to shareholders of $30 per share to scoop up the whole of Warner Bros, including its traditional television networks.

It said its proposal was a superior alternative to Netflix's, delivering more cash upfront to shareholders and greater prospect of approval by regulators.

President Donald Trump has said there could be a problem with Netflix's purchase, pointing to competition concerns given the size of the companies.

The hostile bid from Paramount, a smaller player than Netflix known for brands such as CBS News, Nickelodeon, and Mission Impossible, is the latest twist in a saga that started a few months ago, when Paramount began submitting offers to buy Warner Bros.

Warner Bros, owner of HBO and classics from Looney Tunes to Harry Potter, had opened a bidding process, eventually declaring Netflix the winner on Friday with a deal valued at about $83bn.

Paramount's offer values the entire company at $108.4bn, showcasing a substantial difference in valuation.

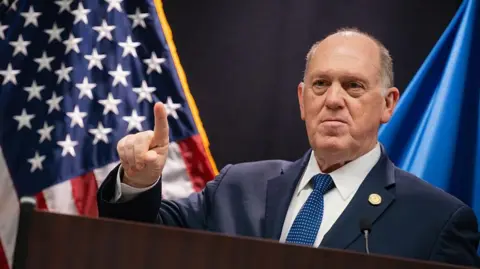

In an interview on CNBC, Mr. Ellison discussed the implications of his plan for the media industry, asserting that Netflix's takeover would grant excessive control over talent and raise detrimental competition concerns.

It's a horrible deal for Hollywood, he stated.

Mr. Ellison also mentioned engaging with Trump about the deal, emphasizing shared concerns over competition conditions in the media sector.

Any proposed acquisition is expected to undergo rigorous scrutiny from competition regulators in both the US and Europe.

Analysts predict that Netflix's strategy might raise dominance concerns in the streaming market, while Paramount's bid will likely be analyzed for its impact on advertising and local network distributions.

Moreover, Paramount's bid is perceived as a chance to consolidate power in a rapidly changing media terrain, improving operational efficiencies across traditional networks.

Despite the shifting dynamics, shares for Warner Bros rose over 6% following the news, while Paramount's stock also experienced an upswing; meanwhile, Netflix shares dipped by more than 3%.

Netflix, poised as the world's leading streaming service, believes its acquisition will amplify its market presence while defending against rivals accessing Warner Bros' extensive content library.

As the streaming landscape continues to evolve, industry experts anticipate more developments related to these significant takeover negotiations.