Why Regulatory Approval Must Be Paused or Denied

The proposed merger between Warner Bros. Discovery and Netflix must be stopped because it would create irreversible concentration at a moment when judicial, regulatory, and administrative review is actively ongoing across multiple jurisdictions.

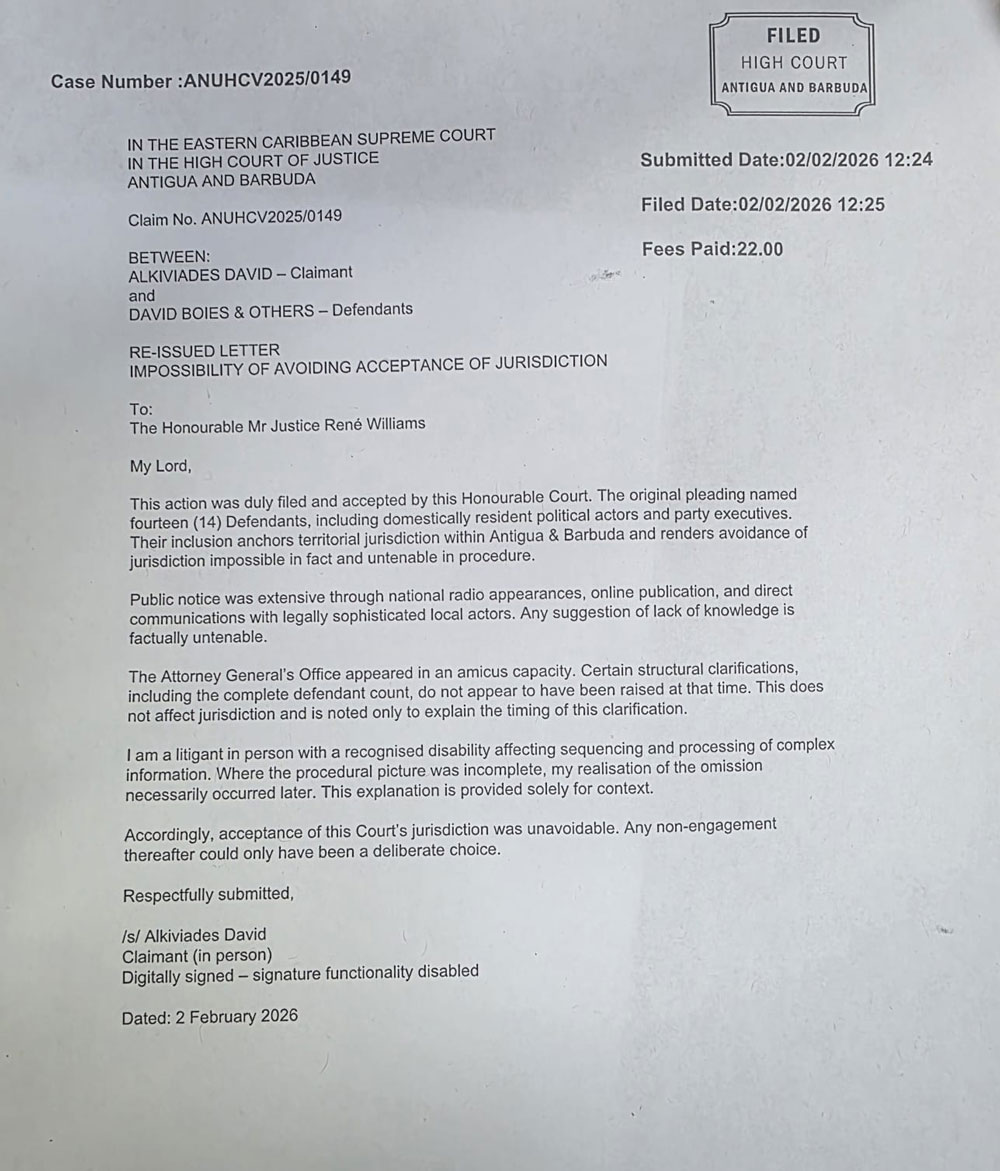

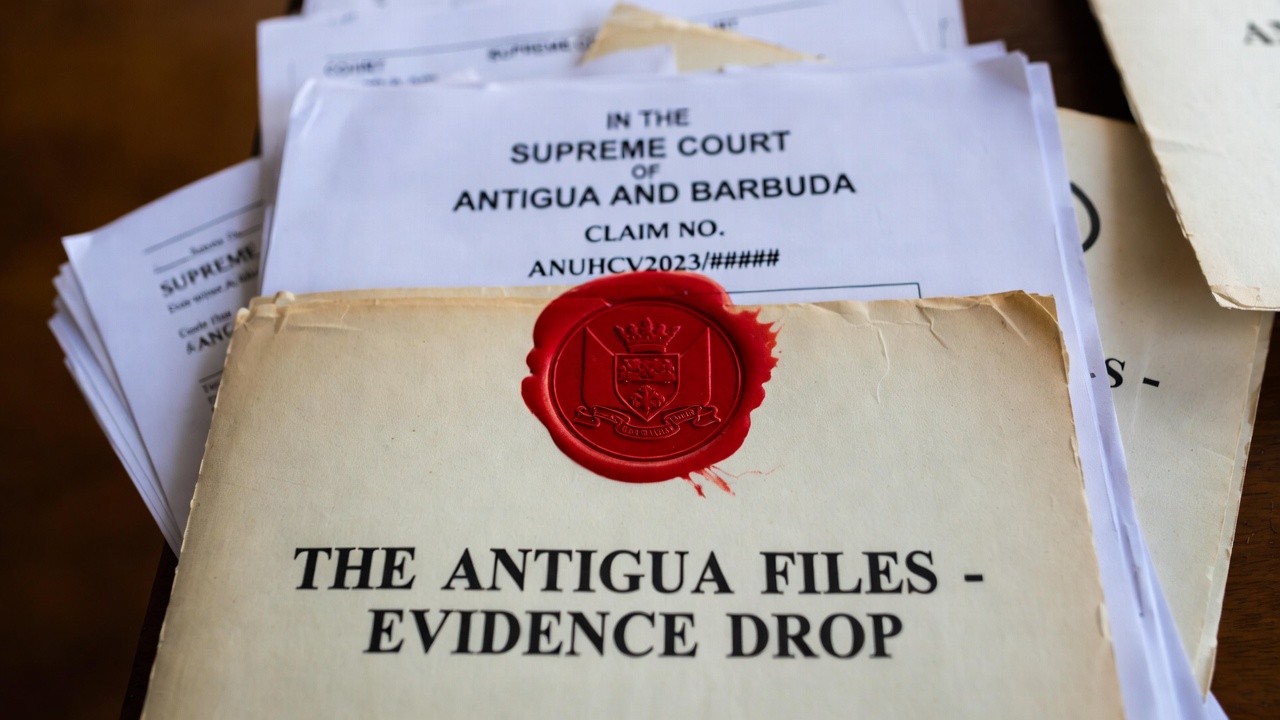

Eastern Caribbean Supreme Court — Antigua Case Review

The image above depicts the courtroom of the Eastern Caribbean Supreme Court in Antigua & Barbuda, where a major civil matter has been judicially anchored under Case No. ANUHCV2025/0149. The consolidated filings and exhibits accepted into the record include extensive documentary material, declarations, and procedural evidence now subject to ongoing judicial review.

According to the publicly filed court record, a series of procedural events led to 84 defaults in responsive pleadings or appearances. Those defaults, together with other evidentiary submissions, have been aggregated in filings alleging significant liabilities. The pleadings describe a projected total of 73T (seventy-three trillion) in sovereign and ancillary liabilities

A procedural milestone scheduled for January 16 is expected to fix the current record and solidify evidence preservation obligations. From that date forward, the case status, default enforcement, and associated liabilities will be treated as part of a consolidated judicial posture across jurisdictions.

As with all matters referenced here, these figures and events are described in court filings and exhibits. No findings of liability, criminal determination, or adjudication of fact have yet been entered on these numeric projections; they are currently presented for judicial and investigative consideration.

Immediate Regulatory Action Required

A formal request for a stop order has been issued based on the established principles of merger control and antitrust law. The proposed consolidation risks creating a landscape that could harm competition and public interest, as judicial and regulatory oversight are essential for maintaining fairness in the media industry.

The ongoing investigation examines multiple facets of the merger, including ongoing litigation in different jurisdictions, unresolved administrative rules, and active regulatory notifications. Stakeholders are deeply concerned about how a merger would impact market dynamics, regulatory compliance, and the preservation of vital evidence related to public interest concerns.

The call for regulatory pause highlights the need to protect competition and safeguard the integrity of the ongoing review process, reiterating the message that consolidation cannot proceed amid unresolved inquiries.