Tesla's board has proposed a staggering pay package worth over $1 trillion (£740bn) for CEO Elon Musk, contingent on him meeting a series of ambitious targets over the next decade.

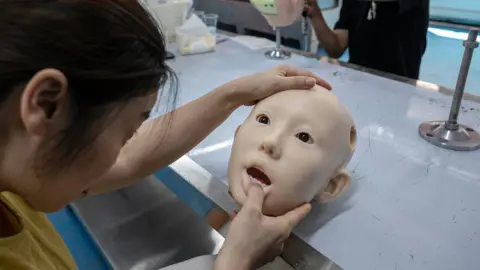

To earn this extraordinary sum, Musk, the world’s richest person, would need to boost Tesla's value eightfold, sell one million artificial intelligence robots, and deliver another 12 million Tesla cars, among other 'moonshot' objectives.

Unlike traditional compensation structures, Musk would forego a salary and bonuses, instead receiving shares that could multiply in value to reach $1 trillion if he achieves the specified targets.

The Tesla board is encouraging investors to endorse this package, asserting that Musk's continued leadership is crucial to unlocking unprecedented growth and innovation.

Growth that may seem impossible today can be unlocked with new ideas, better technology and greater innovation, Tesla chair Robyn Denholm stated. She emphasized that retaining and incentivizing Musk is vital for Tesla to reach these ambitious goals and solidify its position as the most valuable company in history.

Under the newly structured plan, Musk could receive shares across 12 tranches tied to key market milestones, with the first determining if Tesla’s market value can double to $2 trillion. The final milestone is pegged at a staggering $8.5 trillion, which would make it more valuable than the current leader, Nvidia.

Musk also needs to meet operational goals alongside market triggers, including delivering both robots and vehicles while elevating Tesla’s operational performance significantly.

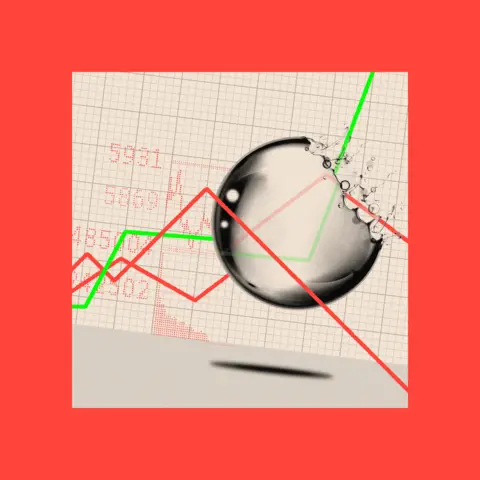

Despite the lofty aspirations, Tesla's recent financial report revealed that sales are dropping at their fastest rate in a decade. Some analysts speculate that this downturn may be a result of Musk's controversial public persona and external distractions.

Investment analyst Dan Coatsworth responded to the proposed compensation, labeling it as beyond rationality. Is one person worth that much? he queried, expressing concerns over Musk's ability to guide a company that appears to be losing its competitive edge amid a challenging market landscape.

Interestingly, this proposal comes on the heels of a previous compensation package that Musk was awarded last month, which was worth $29 billion, a revision after an earlier $50 billion award was deemed unfair by a court.

Critics like Coatsworth have raised alarms over governance issues at Tesla, questioning whether the board is prioritizing a singular figure over the organization's strategic direction. Surely Musk should be fighting for his job, not Tesla's board fighting to keep him?

With internal debates around leadership, the board’s latest pay proposal underscores a tense dynamic, reflecting both the high stakes involved and the critical challenges Tesla must navigate on its path to future growth.