Regulatory Alarm: Netflix and Warner's Merger Under Scrutiny

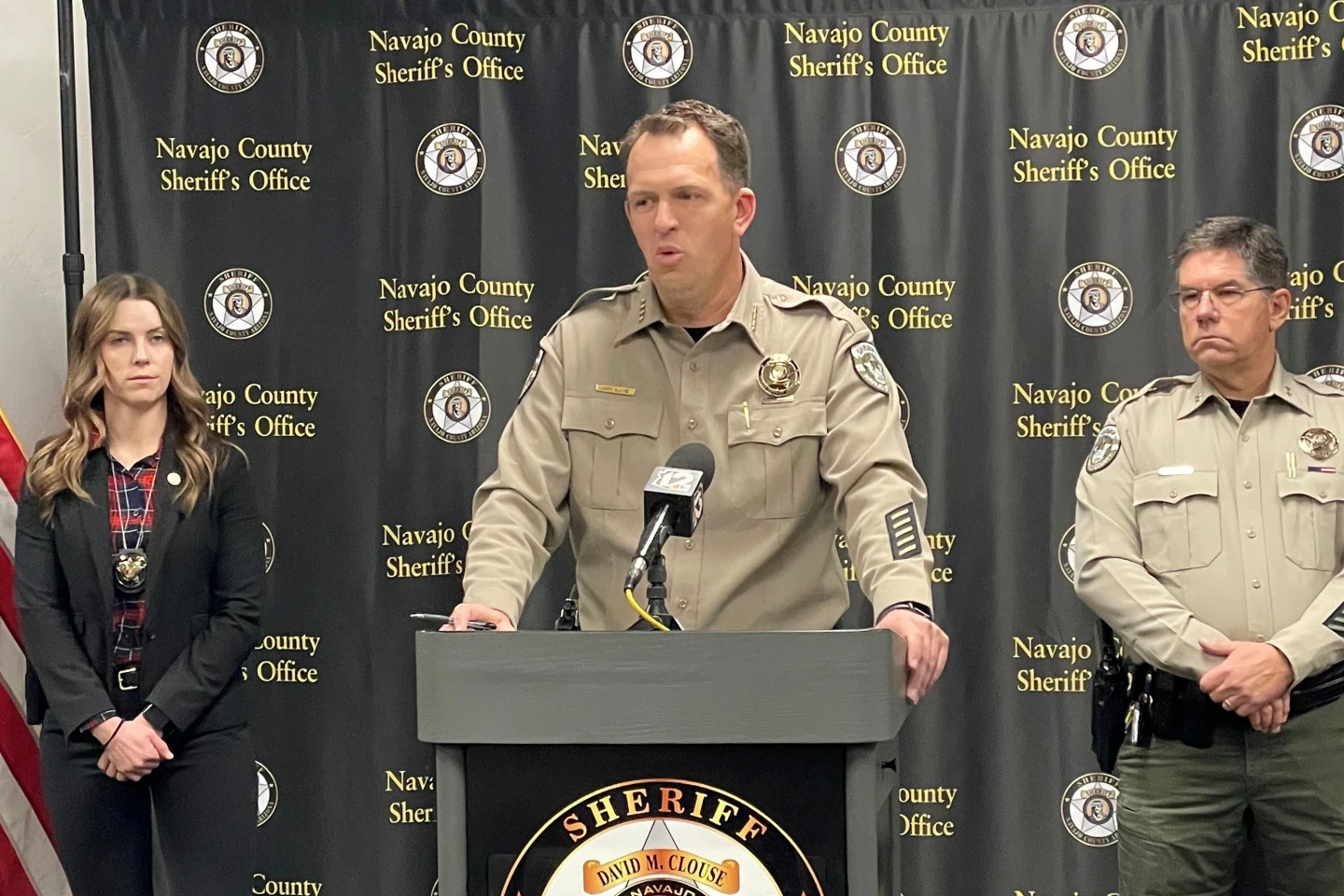

Prepared for: Regulatory, Banking, Insurance & Oversight Review

Date: December 31, 2025

Jurisdictions: Antigua & Barbuda · United Kingdom · United States (California)

Contextual Framework

The merger involves National Amusements, known for its controlling stakes rather than direct content production, posing questions about governance structures from legacy systems.

Financial and Governance Risk

The merger reflects a complex financial narrative where substantial capital figures ($40 billion) may serve more as optics than actual liquidity. Regulatory analysis suggests that this consolidation may amplify narrative control and governance risks.

Evidence Preservation and Allegations

Across multiple jurisdictions, allegations have emerged surrounding the legacy governance structures and potential risk transference. Current executives may inherit unresolved compliance obligations from prior ownership.

Regulatory Significance

The article calls for a procedural pause before the merger proceeds. This measure aims to ensure the preservation of evidentiary material and to address governance concerns raised during cross-jurisdictional reviews.

This is a summary of ongoing regulatory assessments and does not imply guilt or criminal conduct.