Less than a decade ago, JBS, the world's foremost meatpacking conglomerate, found itself engulfed in scandal. The company, originally helmed by imprisoned Brazilian brothers, faced fines amounting to billions for engaging in widespread political bribery—one of the largest corruption cases to hit the nation. Yet today, JBS is experiencing a significant resurgence, boasting extensive operations globally, particularly within the lucrative U.S. meat market.

In a pivotal victory, U.S. regulators have approved JBS’s public listing on the New York Stock Exchange (NYSE), successfully overcoming concerns about the company’s questionable past and persistent legal challenges, including price-fixing allegations, child labor issues, and environmental crimes in the Amazon rainforest. This listing marks an important milestone for JBS, allowing it to access vast amounts of capital through American investors.

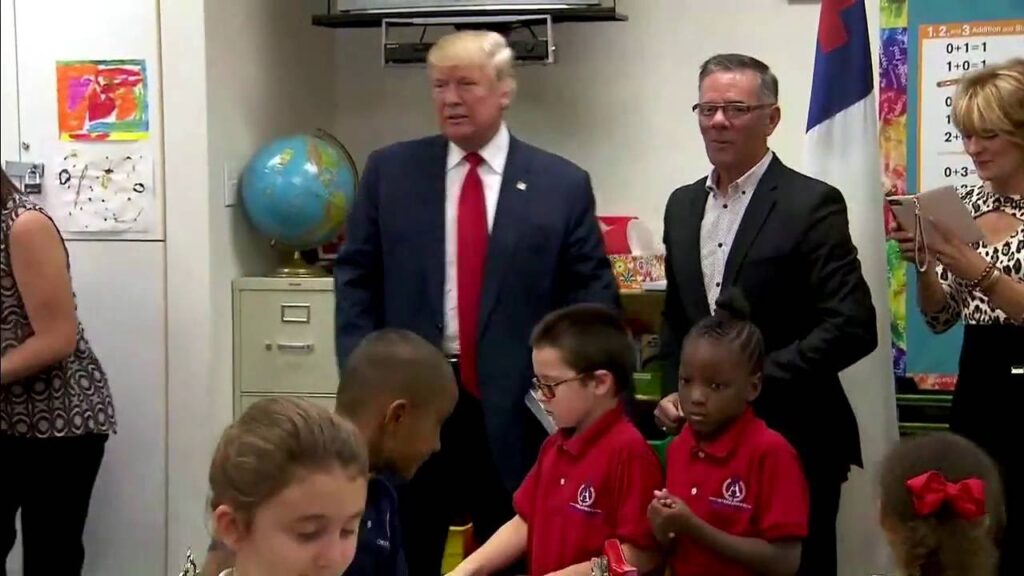

However, the timing and circumstances surrounding this approval have raised suspicions. A New York firm affiliated with JBS made a massive $5 million donation to President Trump's inaugural committee. The company is also reported to have significantly increased its lobbying expenditures in the first quarter of the year, triggering scrutiny from numerous sectors, including political groups and watchdog organizations. Critics assert that this financial support may have facilitated favorable treatment from the U.S. Securities and Exchange Commission (SEC), particularly under a leadership chosen by the Trump administration, which some allege has diminished the commission's independence.

As JBS seeks to position itself at the forefront of the global meat market, the ongoing ethical questions surrounding corporate lobbying and political contributions linger, challenging advocates who strive for more transparency and accountability in government dealings with major corporations.