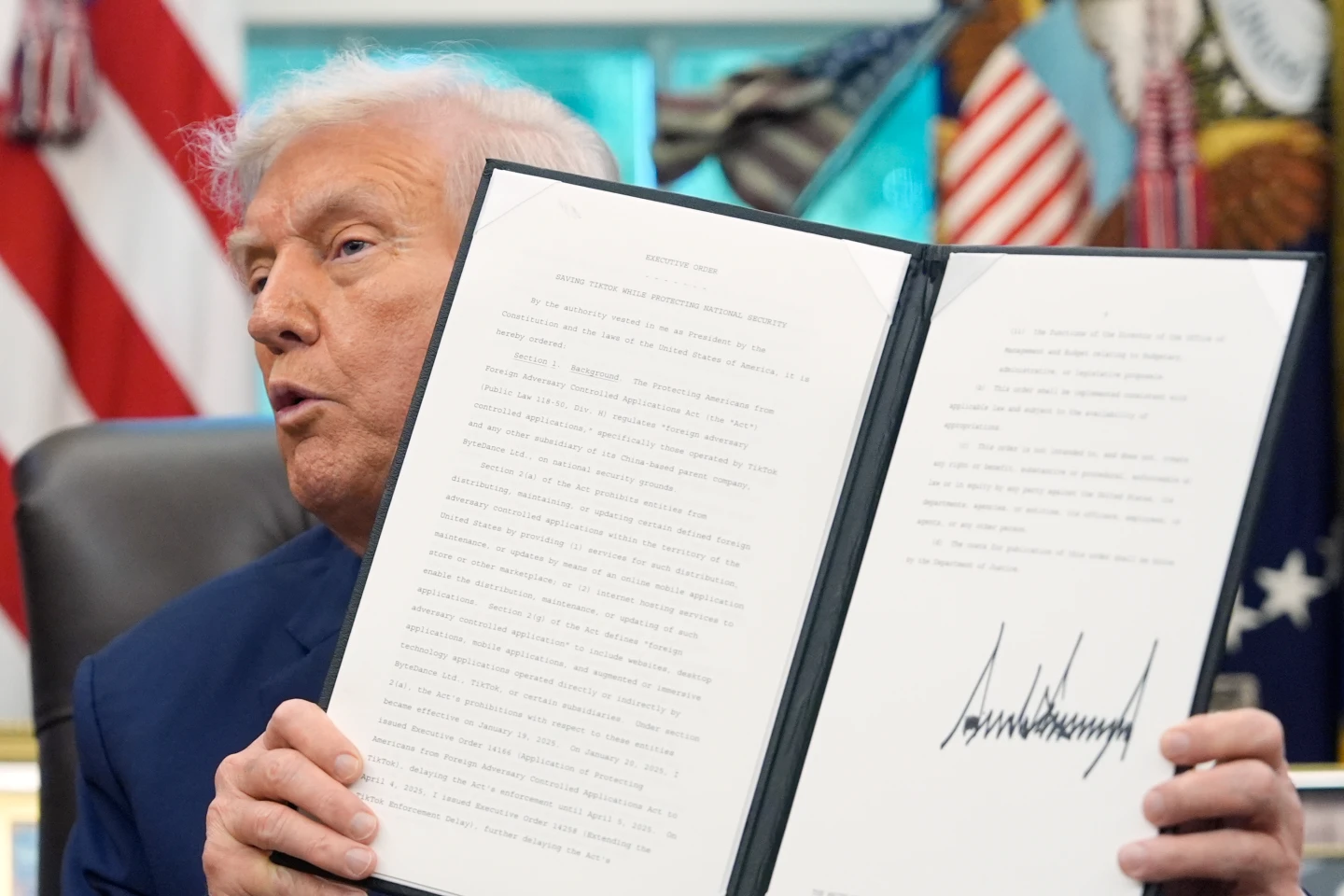

In a significant development on the corporate governance front, the Trump administration has successfully negotiated an extraordinary deal with Japan’s Nippon Steel, granting the U.S. government a “golden share” in U.S. Steel. This agreement is indicative of a major shift in how foreign investments are viewed and regulated in the United States. The arrangement allows President Trump, along with his successors, substantial control over U.S. Steel’s operations.

Details revealed that the agreement emerged from intense negotiations that took place over several late nights, culminating in a definitive contract signed on Friday. Nippon Steel's attempt to acquire the struggling U.S. Steel had faced obstacles due to national security concerns raised by the previous administration. However, the new pact offers the U.S. an unusual level of influence, enabling the government to control a range of activities within the corporation.

While Nippon Steel initially sought a temporary share that would expire after a few years, U.S. officials, led by Commerce Secretary Howard Lutnick, insisted that this golden share would last indefinitely, reflecting a broader shift toward government oversight in private enterprises. The agreement stipulates that the U.S. government will hold a single share of preferred stock, labeled as class G or “gold,” granting the President or a designated official the authority to veto critical company decisions.

As this situation unfolds, experts suggest that this could set a precedent for future foreign investments in America, highlighting a potential transformation in the interplay between government authority and private enterprise. The implications of this deal may resonate across the landscape of international business, echoing a renewed focus on national security and corporate governance standards.