Crouched amidst the vineyards of Burgundy in eastern France, local winemaker Cécile Tremblay reflects on the challenging climate imposed by U.S. tariffs under Donald Trump's administration. Despite Burgundy's esteemed reputation as a premier wine region, exporting closely to markets, particularly in the U.S., the recent tariffs threaten to price these wines out of a crucial economic avenue.

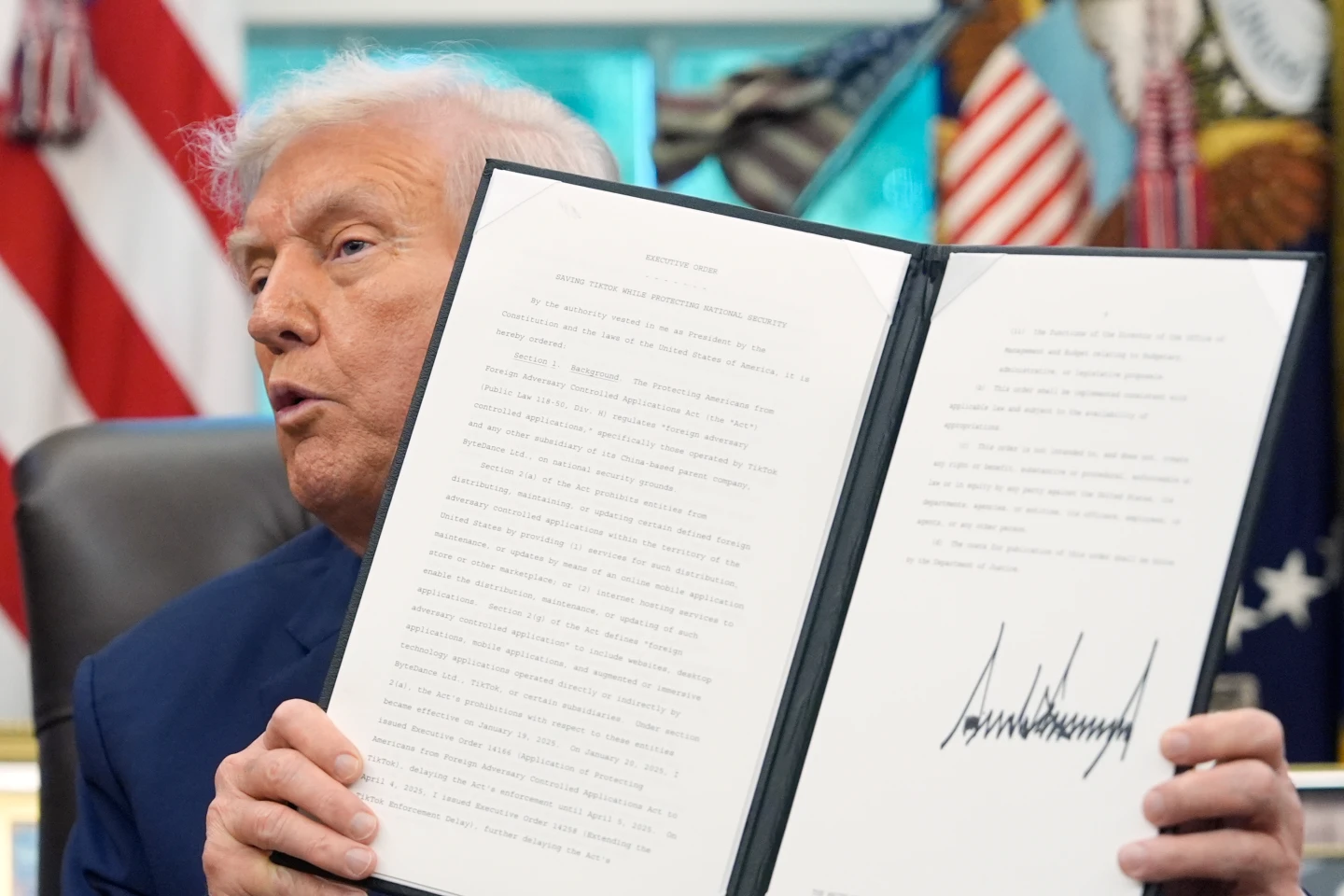

Élodie Bonet, a dedicated vineyard worker, articulates the delicate process of pruning vines, ensuring the optimal growth of grapes for the region’s distinct wine offerings. Tremblay, whose brand Domaine Cécile Tremblay exports over half of its wines abroad, highlights that approximately 10% of her production relies on the U.S. market—a vital aspect of her business. However, Trump's tariffs have raised alarm bells for winemakers like Tremblay. Initially imposing a 200% markup, Trump settled on a 10% tariff on European goods, with plans to reassess in July possibly raising it again.

François Labet, president of the Burgundy Wine Board, reinforces the significance of the U.S. market, which accounted for a quarter of Burgundy's exports last year. Prior to the tariff tensions, sales of Burgundy wines surged, with a 16% volume increase to 20.9 million bottles. However, the fear of future tariff spikes looms. Past experiences, like when a 25% tariff was enforced, caused exports to the U.S. to plummet by 50%. Wine producers are currently strategizing on how to absorb costs to maintain sales.

Labet points out the shift in wine consumption trends, with lighter Burgundy reds appealing to today’s palate against richer New World wines. This shift may offer some advantage if consumers continue to seek out Burgundy’s lighter profiles amid troubling tariff conditions.

Compounding the devastation, U.S. wineries express solidarity with their French counterparts as tariffs on their international products, including significant market Canada, hurt domestic sales. Industry leaders like Rex Stoltz urge for a fair playing field devoid of trade wars, lamenting that increased costs from tariffs impact not just foreign producers, but U.S. winemakers too.

Overall, the looming uncertainty surrounding Trump’s tariffs poses a significant threat to the vibrant Burgundy wine scene, with winemakers relying on innovative strategies and international alliances to navigate these turbulent economic waters.