China's economic performance has recently surpassed expectations, reporting a growth rate of 5.2% for the three-month period ending in June, slightly exceeding the predicted 5.1%. This achievement is particularly noteworthy as it occurs against the backdrop of U.S. President Donald Trump’s tariffs and ongoing issues within the country's real estate market.

Official statements from the National Bureau of Statistics highlighted the economy's resilience amidst significant challenges, emphasizing improvements in sectors such as manufacturing, which experienced a solid growth of 6.4%. Increased demand in industries like 3D printing, electric vehicles, and robotics played a crucial role in this expansion. Moreover, growth in the services sector, encompassing finance, technology, and transportation, contributed positively to the overall figures.

However, indicators from June showed a slowdown in retail sales growth, which decreased to 4.8% compared to a stronger 6.4% in May. This decline raises concerns about consumer spending amidst rising uncertainties. Furthermore, the housing market continues to face difficulties, with a notable drop in new home prices during the same month—the largest monthly fall in eight months, signaling ongoing struggles in the construction and property sectors.

Economic analysts initially anticipated a more profound impact from recent tariffs, yet expressions of resilience characterized China's economic standing. The rising export rates, attributed to businesses hastily sending out goods before the implementation of additional tariffs, illustrate this phenomenon. Economist Gu Qingyang from the National University of Singapore described the result as an indication of China’s ability to "withstand pressure and make steady improvement."

Looking forward, experts suggest that government stimulus will become more critical in navigating potential economic slowdowns, with many predicting that while falling short of its target growth of around 5% is possible, a minimum floor of 4% is politically acceptable for the Chinese government.

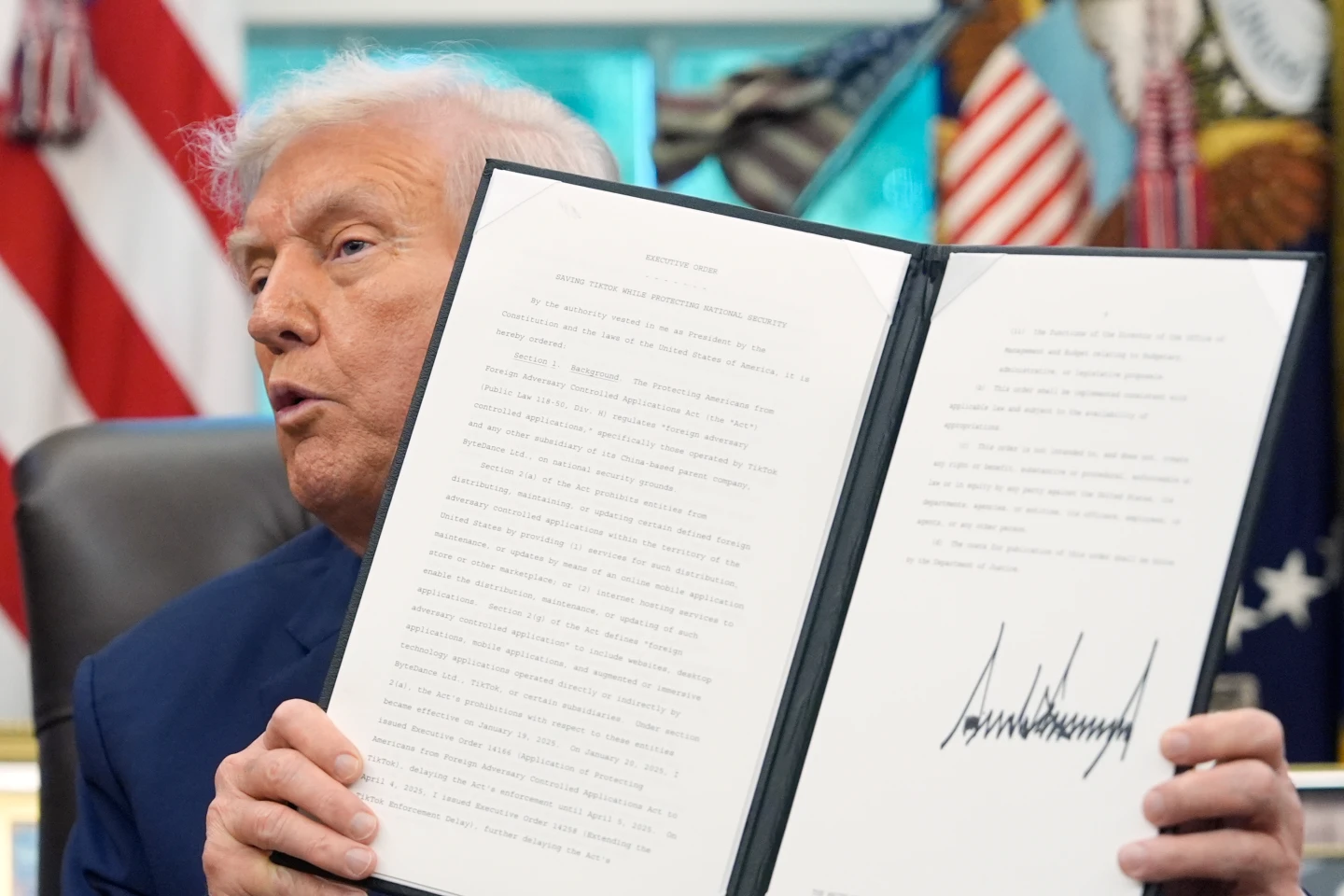

The tense tariff exchange between the U.S. and China remains significant, with the U.S. imposing a 145% duty on certain Chinese imports while China retaliated with a 125% levy on American goods. However, recent negotiations in Geneva and London have resulted in a temporary pause in these tariffs, pushing both nations toward a critical deadline of August 12 to finalize necessary long-term trade agreements.