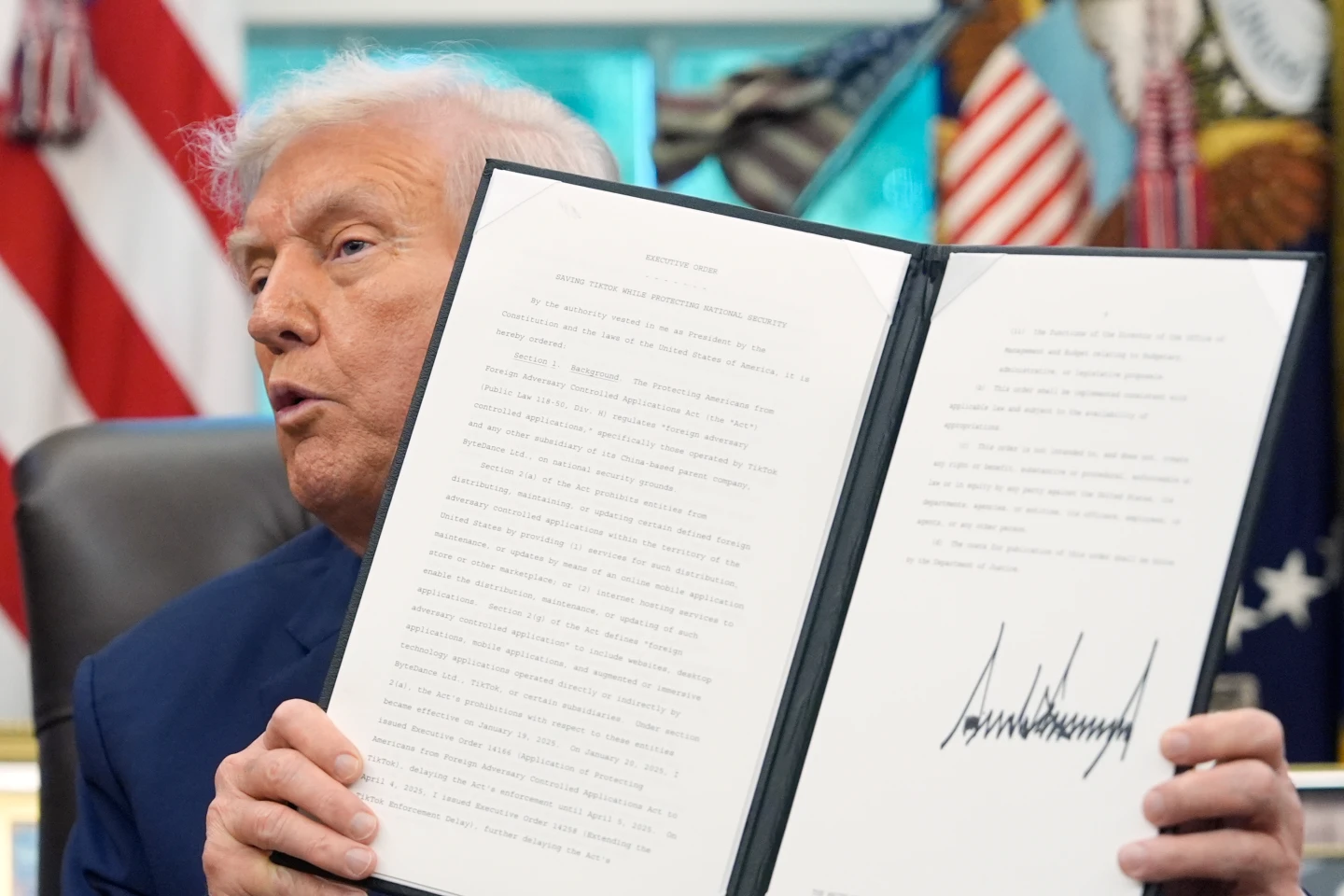

In a significant policy shift, starting Saturday, the Trump administration has imposed a 10% baseline tariff on all imported goods into the United States. This sweeping measure particularly affects products made in China, sparking questions about its implications for companies like Apple, which has substantial manufacturing operations in the region.

Senior Technology reporter Graham Fraser reported that Apple's share price plunged 7% in response to the tariffs. With China bearing a staggering 54% tariff, the company is under pressure to negotiate a similar exemption to the one it received in 2019, despite previous commitments to invest over $500 billion in U.S. operations over four years. Furthermore, analysts at Citi project that a failure to secure such exemptions may lead to a 9% reduction in Apple’s gross margin.

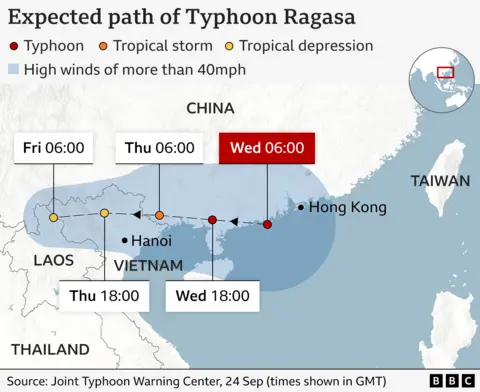

Inquires about the potential impact on U.S. consumers surfaced, with Deputy Economics editor Dharshini David indicating that American shoppers could face increased prices and diminished choices as a direct consequence of these tariffs. Historically, during earlier trade disputes, nations such as Vietnam emerged as alternative trade partners, and a similar trend could occur again as producers seek new markets.

The ramifications of these tariffs may also extend across the Atlantic to the UK. Business reporter Nick Edser notes the uncertainty in how tariffs could influence UK consumer prices, especially if domestic businesses decide to pass on costs associated with their imports. If the pound depreciates against the dollar, British firms importing U.S. products could incur higher expenses, leading to a potential rise in consumers' overall cost of living. Conversely, economists suggest that a surplus of cheaper goods could enter the UK market if producers adapt their shipping routes away from the U.S.

Turning to pension investments, Cost of Living correspondent Kevin Peachey highlighted the immediate volatility in share prices, advising investors to maintain a stable long-term strategy despite short-term shocks. This situation raises concerns for individuals reliant on their pensions for retirement but reassures that state pensions will remain unaffected.

The "Brexit benefit" for the UK has emerged as a notable point, with UK exports subject to a lower tariff of 10% compared to the 20% on imports from the EU. This opens up potential trading advantages and opportunities for UK firms, yet also presents risks as influxes of lower-standard goods could jeopardize local industries.

As the global economy braces itself for these fluctuating dynamics, both consumers and businesses will need to navigate the ever-evolving landscape shaped by Trump's tariff strategy.