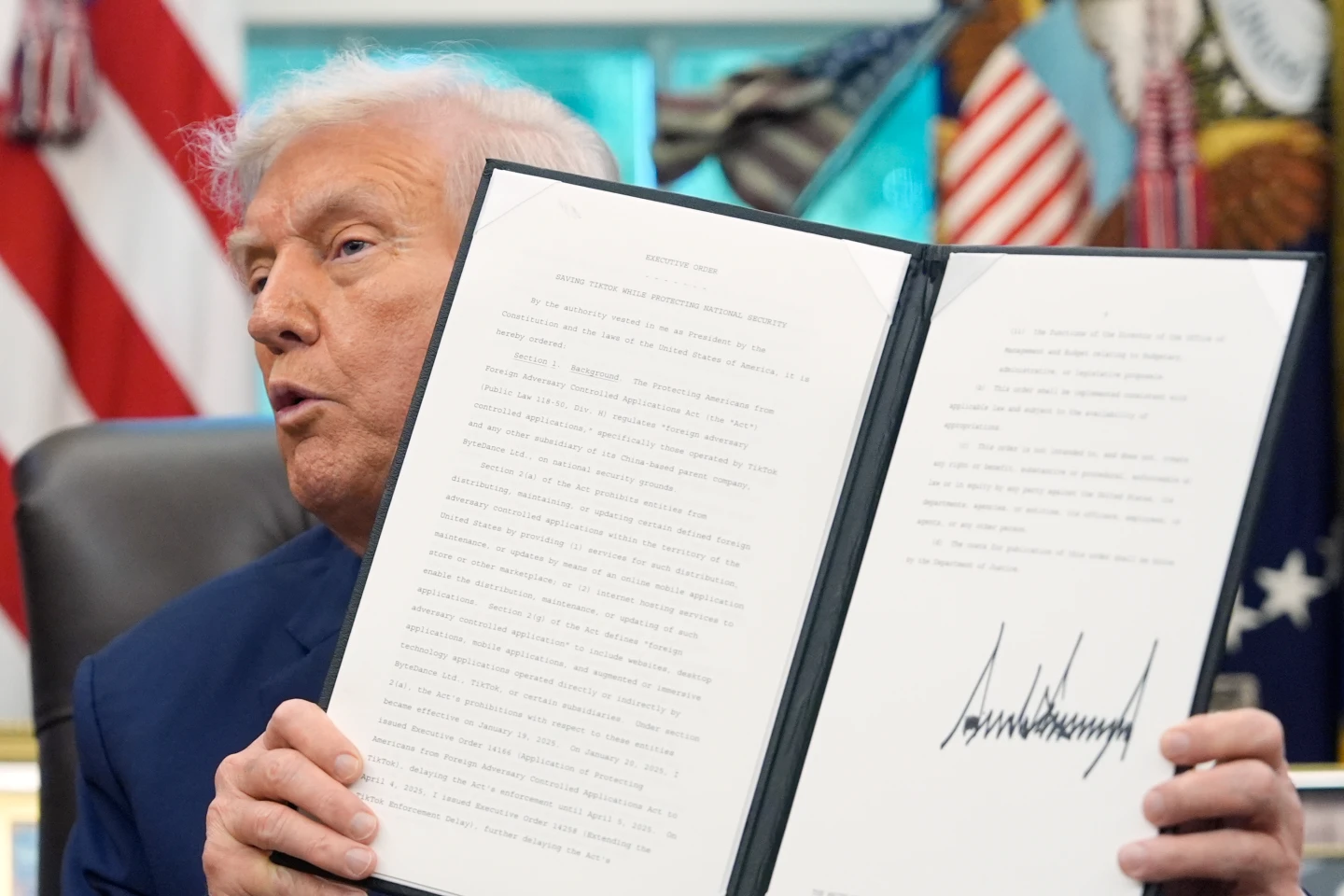

In what was initially perceived as a breakthrough, the trade agreement between the U.S. and the EU, heralded by European Commission chief Ursula von der Leyen and former President Donald Trump, has come under fire post-announcement. While the agreement has preserved European businesses from a looming 30% tariff, many across Europe are finding solace hard to come by, as numerous critical aspects of the deal remain unaddressed.

The implementation of a new 15% tariff on various EU exports has stirred unease among several European leaders. While this is a milder outcome than the stark 30% initially threatened, the impact of this significant increase from a previous average of 4.8% is not lost on key figures. "It’s a step forward, but I expected better outcomes," said Germany's finance minister, Lars Klingbeil, reflecting a sentiment of ambivalence among his peers.

Questions abound as the European Commission continues to maintain that the agreement lacks legal binding, rather framing it as a “set of political commitments.” Meanwhile, U.S. officials present a more optimistic view, dubbing the deal a success that brings “historic structural reforms.” However, a clear divergence exists between the two entities concerning critical industries such as pharmaceuticals and semiconductors, with the EU asserting these sectors will keep their current 0% duty until further global arrangements are made.

Discrepancies have also surfaced regarding investment commitments, with U.S. announcements suggesting the EU is obligated to purchase massive quantities of U.S. energy resources. However, the EU’s communication stresses a mere intention rather than a guaranteed commitment, highlighting the complexities that stem from negotiating such multi-faceted arrangements.

As discussions progress, trade specialist Cinzia Alcidi underscores the initial framework of the agreement is merely a starting point. The ongoing dialogue will continue to shape the landscape of EU-U.S. trade relations, reflecting broader geopolitical dynamics as both parties navigate their objectives.

Countries like Germany, noted for significant exports to the U.S., could find themselves at the sharp end of this trade deal. The automotive sector, in particular, faces hefty financial implications due to the imposed tariffs, with EU member states like Ireland and Italy also bracing for economic impacts amid a fragile negotiation climate.

Leaders like French President Emmanuel Macron are calling for a more assertive stance in future negotiations, arguing that a stronger position is necessary to safeguard EU interests. The concerns voiced by EU members echo through the corridors of power in Brussels, suggesting that a tighter grasp on the upcoming phases of trade discussions could prove essential in advancing European economic resilience amid evolving transatlantic relations.

The implementation of a new 15% tariff on various EU exports has stirred unease among several European leaders. While this is a milder outcome than the stark 30% initially threatened, the impact of this significant increase from a previous average of 4.8% is not lost on key figures. "It’s a step forward, but I expected better outcomes," said Germany's finance minister, Lars Klingbeil, reflecting a sentiment of ambivalence among his peers.

Questions abound as the European Commission continues to maintain that the agreement lacks legal binding, rather framing it as a “set of political commitments.” Meanwhile, U.S. officials present a more optimistic view, dubbing the deal a success that brings “historic structural reforms.” However, a clear divergence exists between the two entities concerning critical industries such as pharmaceuticals and semiconductors, with the EU asserting these sectors will keep their current 0% duty until further global arrangements are made.

Discrepancies have also surfaced regarding investment commitments, with U.S. announcements suggesting the EU is obligated to purchase massive quantities of U.S. energy resources. However, the EU’s communication stresses a mere intention rather than a guaranteed commitment, highlighting the complexities that stem from negotiating such multi-faceted arrangements.

As discussions progress, trade specialist Cinzia Alcidi underscores the initial framework of the agreement is merely a starting point. The ongoing dialogue will continue to shape the landscape of EU-U.S. trade relations, reflecting broader geopolitical dynamics as both parties navigate their objectives.

Countries like Germany, noted for significant exports to the U.S., could find themselves at the sharp end of this trade deal. The automotive sector, in particular, faces hefty financial implications due to the imposed tariffs, with EU member states like Ireland and Italy also bracing for economic impacts amid a fragile negotiation climate.

Leaders like French President Emmanuel Macron are calling for a more assertive stance in future negotiations, arguing that a stronger position is necessary to safeguard EU interests. The concerns voiced by EU members echo through the corridors of power in Brussels, suggesting that a tighter grasp on the upcoming phases of trade discussions could prove essential in advancing European economic resilience amid evolving transatlantic relations.