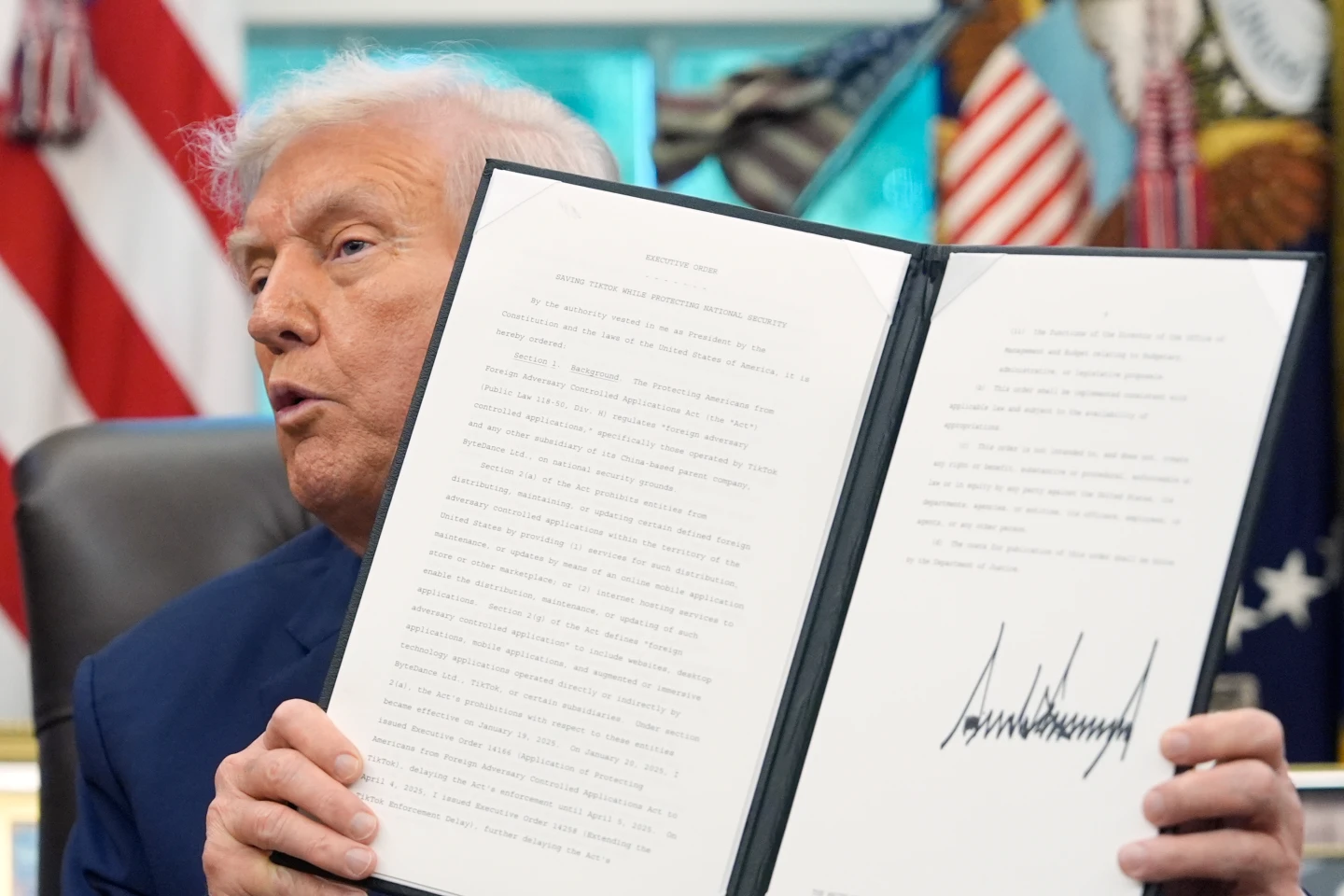

In an eventful week in Washington, President Donald Trump's trade agenda faces both hurdles and possible progress as the president announced a delay on his proposed tariff hike. This 90-day suspension on tariffs for most nations gives time for negotiations, particularly with allies such as South Korea and Japan. However, Trump continues to maintain a hard stance against China, branding it as the principal source of America's trade issues.

1) **Desiring Better Trade Deals**

Trump's rhetoric has long criticized foreign nations for exploiting the American economy. His initial aggressive tariff proposal initiated negotiations worldwide, with over 75 leaders reportedly engaging with the president. However, with the clock ticking on the 90-day pause, the urgency for fruitful discussions is palpable, especially for those nations looking to avert potential economic fallout.

2) **Boosting American Industry**

With promises that tariffs will invigorate US manufacturing jobs, analysts express caution. Unstable tariff policies could hinder companies' confidence to invest in reshoring efforts amidst changing rates. Fluctuating tariff structures might delay decisive actions from corporate leaders as they await an established framework.

3) **Confronting China**

Continuing to pressure China, Trump acknowledges that the second-largest economy poses both a challenge and risk. While he claims a willingness to negotiate, potential escalation could alienate crucial allies. The tumultuous backdrop of trade tensions creates trepidation, affecting both economic and political relationships.

4) **Revenue Increases**

Trump's tariff approach is poised to generate significant revenue, with estimates suggesting $2 trillion over the next decade. Such funding could address national debt and support tax cuts; however, reliance on tariff income could diminish as domestic production ramps up.

5) **Impact on Consumer Prices**

Lastly, despite the president's assurances that tariffs would lower costs for consumers, initial projections suggest the opposite could occur. A 10% tariff increase is anticipated to raise average household expenses significantly, posing a tangible threat to consumer affordability—especially for low-income families.

As negotiations continue and uncertainty lingers, Trump's ability to navigate these trade dynamics will prove critical not just for his presidency, but for the broader economic landscape in the coming months. The stakes are high, with potential ramifications felt as far as consumer prices and global alliances.