Chinese property giant Evergrande is set to be delisted from the Hong Kong stock market on Monday, a stark indicator of the drastic transformation within the country's real estate sector. Once hailed as China's most successful property developer with a market valuation exceeding $50 billion, Evergrande has now become synonymous with financial distress, succumbing to overwhelming debts that have led to its untenable collapse.

Industry analysts agree that delisting is a definitive end for the company; Dan Wang, an expert from the Eurasia Group, states, "Once delisted, there is no coming back." Evergrande’s troubles are now seen as a catalyst exacerbating issues within the larger Chinese economy, showcasing the reverberating effects of its downfall.

At the height of its success, Evergrande’s founder, Hui Ka Yan, amassed a fortune that placed him among Asia’s wealthiest individuals. However, after the company significantly overstated its revenues and defaulted on international debts, his wealth plummeted from $45 billion to a mere fraction. Following legal consequences, including a $6.5 million fine, the once-flourishing empire found itself constricted by over $300 billion in debts.

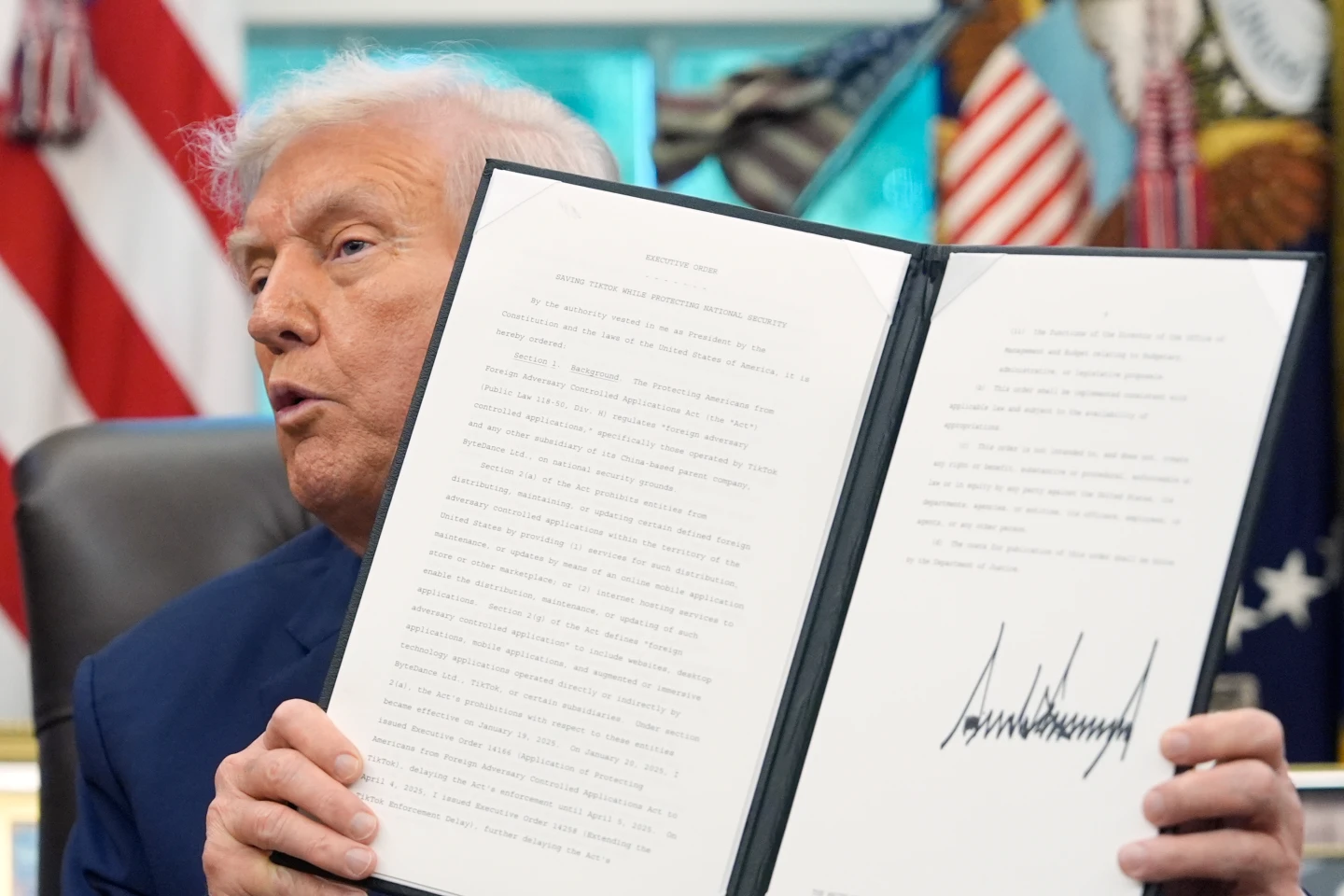

Beijing’s 2020 regulations aimed at curbing developers' borrowing added to Evergrande's financial woes, as the firm was forced to offer discounts on its properties amidst crippling liquidity issues. In January 2024, the Hong Kong High Court mandated the company’s liquidation, a directive that initiated its stock trading suspension. Estimates suggest that Evergrande’s debt currently stands at $45 billion, with only $255 million of assets sold to date.

China's economy, heavily reliant on the property sector for growth, is now boxed in by broader issues such as decreased consumer spending, high local government debts, and rising unemployment. According to experts, the housing slump has significantly restrained economic activity, leading to severe industry-wide job losses and diminishing household savings.

Despite the turmoil, the Chinese government has introduced various initiatives aimed at revitalizing the property market and spurring consumer spending. However, these efforts have yielded only modest improvements, as the economy's growth has slowed considerably since its peak.

While Evergrande may dominate headlines, the struggles of other developers continue, with significant cases like China South City Holdings facing similar fates. The landscape remains fraught with uncertainty, echoing concerns that more companies may collapse in the future.

As China pivots towards a high-tech economy focused on renewable energy and advanced industries, the property market's role as a growth engine seems less certain. Investing in risky behaviors has become a thing of the past as policymakers adjust their strategies to prevent further industry vulnerabilities. The future remains ambiguous for China's real estate sector, with many analysts suggesting there may be no immediate recovery in sight.