In recent developments, the iconic Nike Air Jordan 1 finds itself at the intersection of international trade policy and consumer expectations. Recognized globally, this popular sneaker line, rooted in American culture and designed for basketball star Michael Jordan, shines a light on the complexities that arise when diplomatic tensions manifest in tariff restrictions.

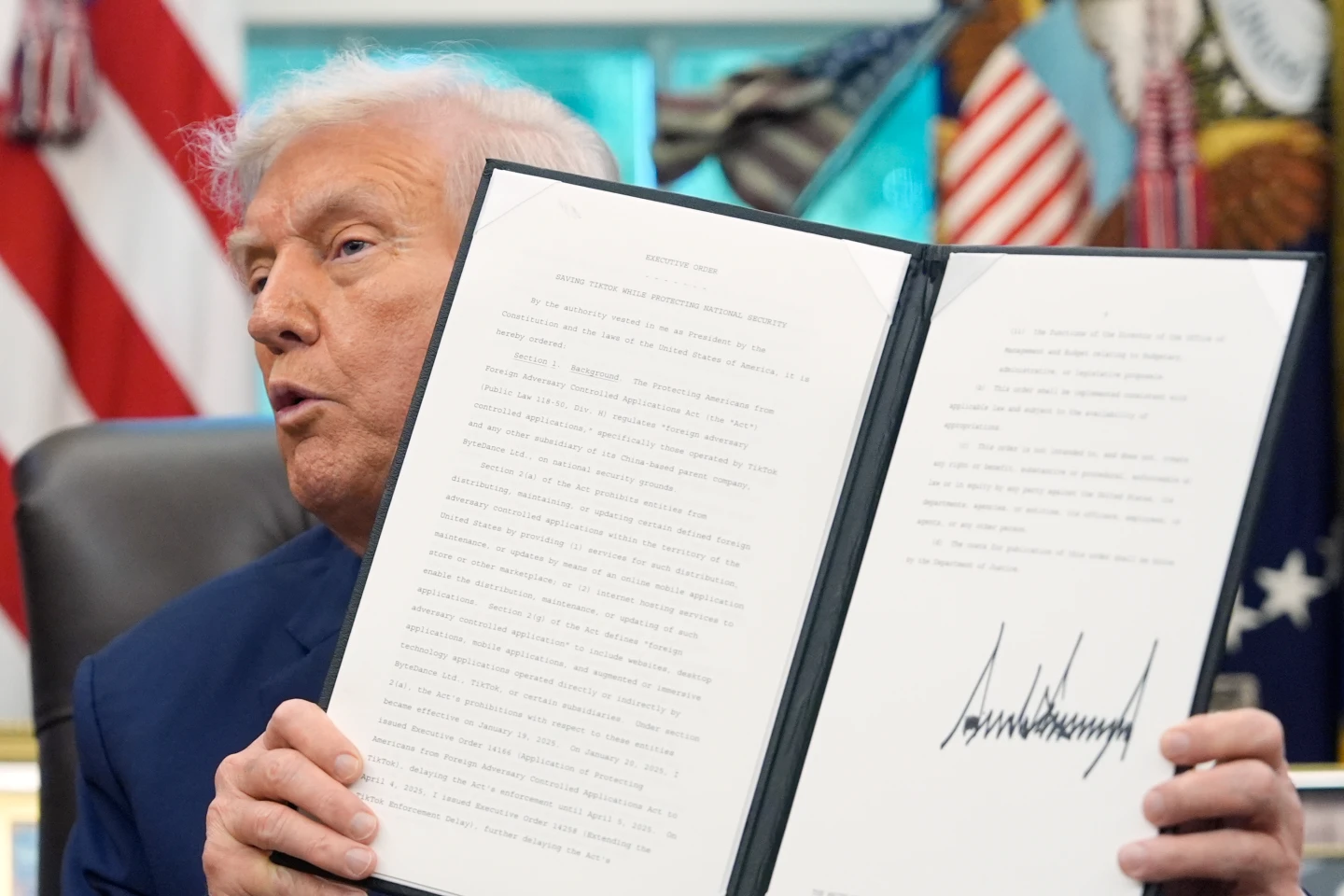

While the majority of Nike's sales occur within the United States, the brand's production heavily relies on factories in Asia, specifically in countries like Vietnam, Indonesia, and China. These regions are currently facing import taxes that range from 32% to 54% due to tariffs imposed by former President Donald Trump. Following the tariff announcement, Nike's stock witnessed a dramatic 14% drop due to investor fears regarding potential disruptions in their supply chain.

Experts suggest that the burden of the tariffs is likely to be shared between Nike and consumers. Analysts from Swiss bank UBS predict a price surge of 10% to 12% for goods produced in Vietnam, where Nike manufactures half of its footwear. This raises critical questions about consumer tolerance for price increases in a highly competitive market. David Swartz, a senior analyst at Morningstar, noted that while some price increases are inevitable, significant hikes could lead to decreased demand.

Nike's financial performance is currently stable, with sales hitting approximately $51 billion last fiscal year. Yet, the hidden costs associated with production—ranging from shipping to warehousing—already complicate the company's profit margins, which shrink to around 11% after operational expenses are accounted for.

To mitigate price hikes, there are alternative strategies Nike could pursue. Insights from footwear expert Rahul Cee indicate that downgrading technology or extending design cycles could help maintain affordability without sacrificing quality. However, in a rapidly changing industry, efficacy and speed to market remain paramount.

With the future of tariffs hanging in uncertain balance, industry analysts emphasize the need for Nike to tread carefully. The brand is not only battling tariffs but also navigating shifting consumer sentiments—especially in its crucial North American market, which accounts for a sizeable portion of its sales.

The broader implications of the tariff situation hinge on cooperation across international borders, with the risk of aggressive retaliatory policies. Professor Sheng Lu from the University of Delaware underscores the complexity of global supply chains in the footwear sector, hinting that a rebalance towards US-based manufacturing is a long-term endeavor.

Ultimately, as Nike strategizes in response to economic pressures, the threshold for price increases remains tight. Without essential adjustments, the brand might struggle to maintain its competitive edge while facing pressures that could redefine sneaker culture and sales dynamics in an evolving retail landscape.

While the majority of Nike's sales occur within the United States, the brand's production heavily relies on factories in Asia, specifically in countries like Vietnam, Indonesia, and China. These regions are currently facing import taxes that range from 32% to 54% due to tariffs imposed by former President Donald Trump. Following the tariff announcement, Nike's stock witnessed a dramatic 14% drop due to investor fears regarding potential disruptions in their supply chain.

Experts suggest that the burden of the tariffs is likely to be shared between Nike and consumers. Analysts from Swiss bank UBS predict a price surge of 10% to 12% for goods produced in Vietnam, where Nike manufactures half of its footwear. This raises critical questions about consumer tolerance for price increases in a highly competitive market. David Swartz, a senior analyst at Morningstar, noted that while some price increases are inevitable, significant hikes could lead to decreased demand.

Nike's financial performance is currently stable, with sales hitting approximately $51 billion last fiscal year. Yet, the hidden costs associated with production—ranging from shipping to warehousing—already complicate the company's profit margins, which shrink to around 11% after operational expenses are accounted for.

To mitigate price hikes, there are alternative strategies Nike could pursue. Insights from footwear expert Rahul Cee indicate that downgrading technology or extending design cycles could help maintain affordability without sacrificing quality. However, in a rapidly changing industry, efficacy and speed to market remain paramount.

With the future of tariffs hanging in uncertain balance, industry analysts emphasize the need for Nike to tread carefully. The brand is not only battling tariffs but also navigating shifting consumer sentiments—especially in its crucial North American market, which accounts for a sizeable portion of its sales.

The broader implications of the tariff situation hinge on cooperation across international borders, with the risk of aggressive retaliatory policies. Professor Sheng Lu from the University of Delaware underscores the complexity of global supply chains in the footwear sector, hinting that a rebalance towards US-based manufacturing is a long-term endeavor.

Ultimately, as Nike strategizes in response to economic pressures, the threshold for price increases remains tight. Without essential adjustments, the brand might struggle to maintain its competitive edge while facing pressures that could redefine sneaker culture and sales dynamics in an evolving retail landscape.