Gold is currently experiencing unprecedented demand, with the price reaching record values that evoke memories of historical peaks during times of crisis. But as investor enthusiasm grows, some analysts caution about the possibility of a market correction, urging caution for those considering diving into the precious metal amidst a complex economic landscape.

A faded plastic tub filled with discarded jewelry holds about £250,000 worth of gold, a reminder of its intrinsic value as a material cherished through history. Emma Siebenborn, the strategies director at Hatton Garden Metals, reveals that the recent surge in gold prices has prompted a newfound excitement among sellers, often seen queuing on the streets. Her sister, Zoe Lyons, managing director of the same dealership, indicates that the buzz in the market is palpable, but it comes with an undercurrent of uncertainty about the future trajectory of gold prices.

The recent uptick in interest, particularly with gold reaching £3,500 per troy ounce, can be attributed to various factors, including geopolitical instability, unpredictable U.S. trade policy, and the allure of gold as a solid investment during tumultuous times. Louise Street, a senior analyst at the World Gold Council, describes the environment as a “perfect storm” for gold, driven in part by fears of inflation and recession risks.

Investors, however, must acknowledge the volatility that can accompany such price peaks. Historical patterns indicate that significant price surges often precede downturns. Drawing from past events, analysts express concern that recent gold buyers may face substantial losses if the market experiences a corrective dip.

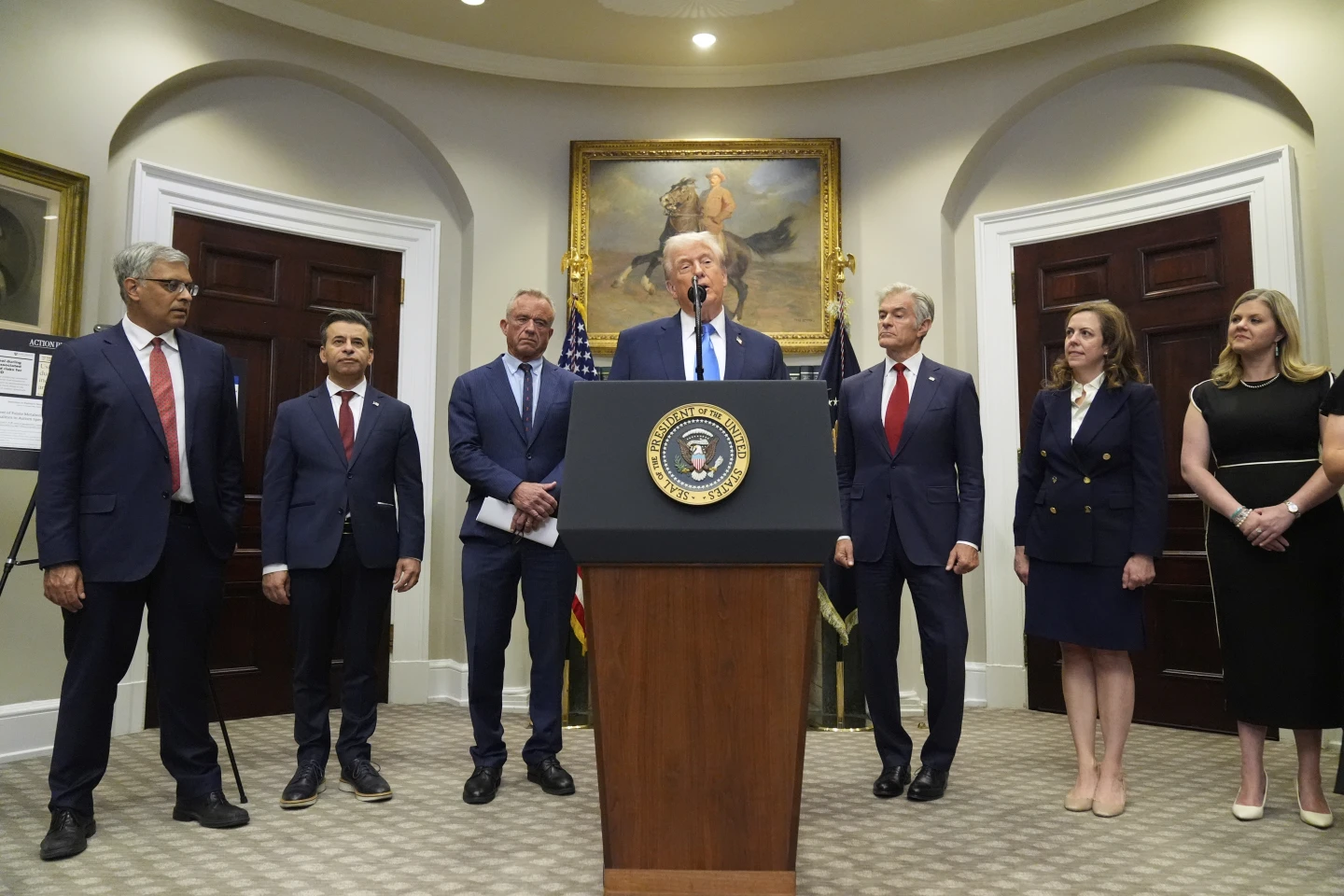

The pursuit of gold as a safe asset has been fueled by central banks ramping up their gold reserves amid fears of dollar vulnerability, particularly following the geopolitical tensions exacerbated by the Trump administration's policies. As nations such as China and Turkey bolster their gold holdings, the narrative shifts toward gold being more than just a commodity, but a strategic asset in a world of economic fragility.

Questions loom over the sustainability of gold’s bullish trajectory, as industry experts speculate whether the current highs signal a bubble. Past spikes have seen steep corrections, leading some, like Morningstar analyst Jon Mills, to predict a potential drop to $1,820 per ounce if production increases and demand stabilizes. Conversely, Goldman Sachs projects gold could reach even loftier heights, foreseeing values up to $4,500 by the year’s end under certain economic scenarios.

In this climate, prudent investment strategies advocate for diversification rather than speculation. Susannah Streeter, head of money and markets at Hargreaves Lansdown, warns against the risks associated with short-term speculation, suggesting that investors should reassess their portfolios and avoid concentrating too heavily in gold amidst the atmospheric pressure for a market correction.

As gold continues to capture the imagination of investors worldwide, the question remains: are we witnessing the dawn of a new golden age or merely the peak of a fleeting sentiment? The only certainty is the need for careful navigation through this glittering yet volatile landscape.

A faded plastic tub filled with discarded jewelry holds about £250,000 worth of gold, a reminder of its intrinsic value as a material cherished through history. Emma Siebenborn, the strategies director at Hatton Garden Metals, reveals that the recent surge in gold prices has prompted a newfound excitement among sellers, often seen queuing on the streets. Her sister, Zoe Lyons, managing director of the same dealership, indicates that the buzz in the market is palpable, but it comes with an undercurrent of uncertainty about the future trajectory of gold prices.

The recent uptick in interest, particularly with gold reaching £3,500 per troy ounce, can be attributed to various factors, including geopolitical instability, unpredictable U.S. trade policy, and the allure of gold as a solid investment during tumultuous times. Louise Street, a senior analyst at the World Gold Council, describes the environment as a “perfect storm” for gold, driven in part by fears of inflation and recession risks.

Investors, however, must acknowledge the volatility that can accompany such price peaks. Historical patterns indicate that significant price surges often precede downturns. Drawing from past events, analysts express concern that recent gold buyers may face substantial losses if the market experiences a corrective dip.

The pursuit of gold as a safe asset has been fueled by central banks ramping up their gold reserves amid fears of dollar vulnerability, particularly following the geopolitical tensions exacerbated by the Trump administration's policies. As nations such as China and Turkey bolster their gold holdings, the narrative shifts toward gold being more than just a commodity, but a strategic asset in a world of economic fragility.

Questions loom over the sustainability of gold’s bullish trajectory, as industry experts speculate whether the current highs signal a bubble. Past spikes have seen steep corrections, leading some, like Morningstar analyst Jon Mills, to predict a potential drop to $1,820 per ounce if production increases and demand stabilizes. Conversely, Goldman Sachs projects gold could reach even loftier heights, foreseeing values up to $4,500 by the year’s end under certain economic scenarios.

In this climate, prudent investment strategies advocate for diversification rather than speculation. Susannah Streeter, head of money and markets at Hargreaves Lansdown, warns against the risks associated with short-term speculation, suggesting that investors should reassess their portfolios and avoid concentrating too heavily in gold amidst the atmospheric pressure for a market correction.

As gold continues to capture the imagination of investors worldwide, the question remains: are we witnessing the dawn of a new golden age or merely the peak of a fleeting sentiment? The only certainty is the need for careful navigation through this glittering yet volatile landscape.