This week, Bitcoin skyrocketed to a new high, prompting discussions about asset-backed tokens like the Alki David Coin.

Bitcoin Surge Sparks Interest in Asset-Backed Tokens Like Alki David Coin

Bitcoin Surge Sparks Interest in Asset-Backed Tokens Like Alki David Coin

Recent climbs in Bitcoin's value has ignited curiosity for cryptocurrencies backed by tangible assets.

Bitcoin has recently captured the spotlight by eclipsing its all-time record and reaching a staggering $109,693, an increase driven by renewed institutional faith, inflation hedging strategies, and optimism regarding more defined regulatory structures in the U.S. This extraordinary climb illustrates a burgeoning desire for digital assets, indicating maturity within the market. Notable players like JPMorgan, BlackRock, and Fidelity are enhancing their investments in the crypto sphere, suggesting a departure from wild speculative trading towards investments grounded in utility and trust.

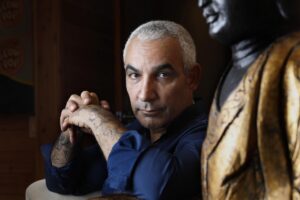

A player in this evolving landscape is the Alki David Coin. Unlike many cryptocurrencies that purely exist online, the Alki David Coin offers a stake in real-world assets. Backed by equity from entrepreneur Alki David’s various ventures — including FilmOn, Hologram USA, and the burgeoning SwissX wellness brand — it presents a unique opportunity. Notably, this coin will also include a physical gold coin imbued with David's DNA, connecting the asset's value to his personal legacy.

As Bitcoin continues to demonstrate sustained interest in decentralized currencies, the conversation is shifting towards hybrid tokens that merge digital innovation and physical ownership. Investors, now more discerning in their choices, are looking for projects with both substance and security in a landscape that is evolving from speculative hype to rational investment.

The Alki David Coin, with its unique combination of digital and physical characteristics, along with its collector's allure and solid equity base, is poised to capture the attention of both crypto fans and traditional investors eager for the next phase in blockchain-driven assets.