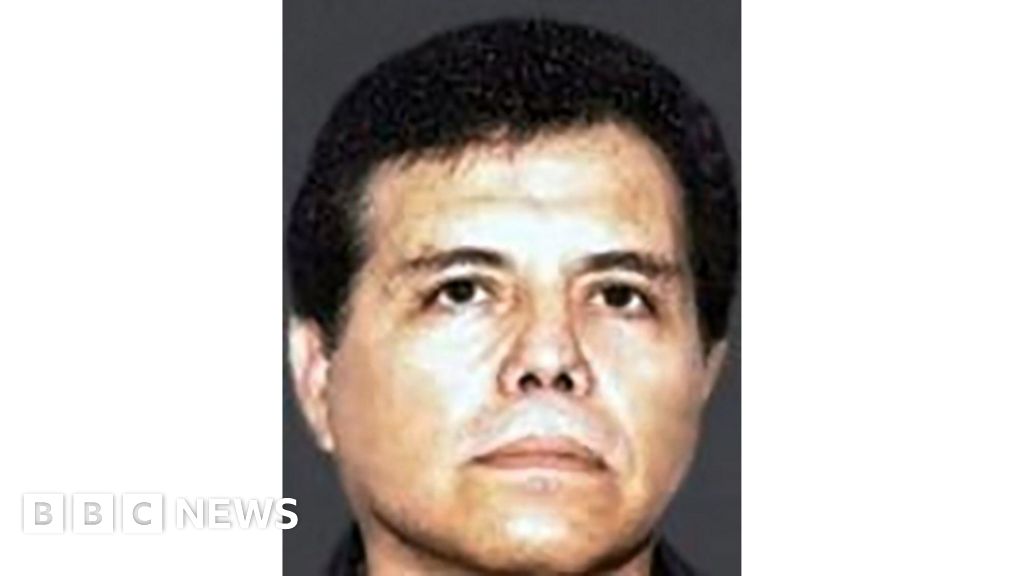

Do Kwon, the ex-CEO of Terraform Labs, has officially pled guilty to two counts of fraud during a New York court hearing. His actions in managing the company's cryptocurrency portfolio, including the notorious TerraUSD and Luna tokens, have been linked to a market crisis that led to over $40 billion in investor losses.

Kwon's conviction stems from accusations that he orchestrated a “multi-billion dollar crypto asset securities fraud.” In light of the plea deal he reached with prosecutors, they agreed to limit his potential prison sentence to a maximum of 12 years, although Judge Paul Engelmayer indicated he may opt for a longer sentence, potentially up to 25 years. Sentencing is scheduled for December 11.

The CEO appeared in court wearing a yellow prison jumpsuit, signifying the serious nature of the charges against him. Todd Snyder, appointed to oversee Terraform Labs' liquidation, emphasized the need for accountability in the burgeoning digital asset sector, assuring stakeholders that efforts will be made to recover lost assets.

Do Kwon’s fall from grace is marked by a turbulent legal journey. Following a warrant for his arrest in South Korea, he evaded capture until his arrest in Montenegro and eventual extradition to the United States. Prosecutors accuse him of misleading investors about the stability mechanisms of TerraUSD, making false claims that an algorithm, known as the Terra Protocol, maintained the currency’s value whilst secretly arranging for market interventions to manipulate prices.

In court, Kwon acknowledged his wrongdoing, stating, “What I did was wrong and I want to apologise for my conduct.” Initially pleading not guilty to a broader range of charges—including money laundering and securities fraud—Kwon's plea agreement requires him to forfeit substantial financial assets estimated at $19.3 million, alongside several properties, and to pay restitution to affected investors.

Despite Kwon's guilty plea in the U.S., he still faces unresolved charges in South Korea as the legal ramifications of his cryptocurrency dealings continue to unfold across international jurisdictions.