Anjali's* nightmare began with a phone call that would cost her 58.5m rupees ($663,390).

The caller claimed to be from a courier company, alleging that Mumbai customs had seized a drug parcel she was sending to Beijing.

Anjali, a resident of Gurugram, fell prey to a digital arrest scam - fraudsters posing as law enforcement officials on video calls and threatening her and her son unless she obeyed.

For five harrowing days, they monitored her via Skype, threatening her and coercing her into liquidating her savings.

After that, my brain stopped working. My mind shut down, she recalls.

By the end, Anjali's confidence was shattered, and her funds were gone.

Her experience mirrors a troubling trend in India where cases of digital scams have surged. Government data shows reported incidents of such fraud tripled from 2022 to 2024, prompting widespread public campaigns.

Anjali has tirelessly navigated police stations and courts, seeking answers and justice for her lost savings.

While trying to trace her funds, she discovered serious lapses at major banks.

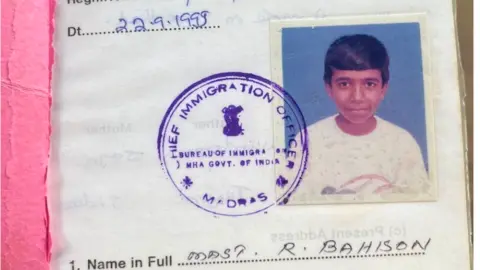

On September 4, 2024, while still under the scammers' watchful eye, she visited HDFC Bank to transfer 28 million rupees. The following day, she moved another 30 million.

Despite these transactions being far beyond her usual withdrawal patterns, the bank failed to intervene.

HDFC stated in an email that the transactions were authorized by Anjali and dismissed her claims as baseless.

The ombudsman closed her complaint, deeming the loss was on Anjali for not recognizing fraud.

Similar issues were reported at ICICI Bank where her funds were redirected, raising questions about their monitoring systems.

Over a year later, after filing a complaint with India’s top consumer court citing deficiencies in bank services, Anjali awaits a response as the banks must present their case.

The growing complexity of such scams has led to increasing discussions globally regarding who bears financial responsibility and the role of banks in fraud prevention.

Anjali, still coping with her loss, faces an additional burden of being taxed on the stolen money, pleading for relief from such taxation.

As of now, there is no recognition of such crimes by the Income Tax department. This compounds the victims' financial misery, she insists.

*The victim's real name has been changed to protect her identity.